Neodymium, a key component in high-strength permanent magnets, has seen significant price fluctuations in recent years. This article provides an in-depth analysis the price trend of neodymium, factors influencing these trends, and forecasts for 2024.

Historical Overview of Neodymium Prices

Long-Term Price Trends

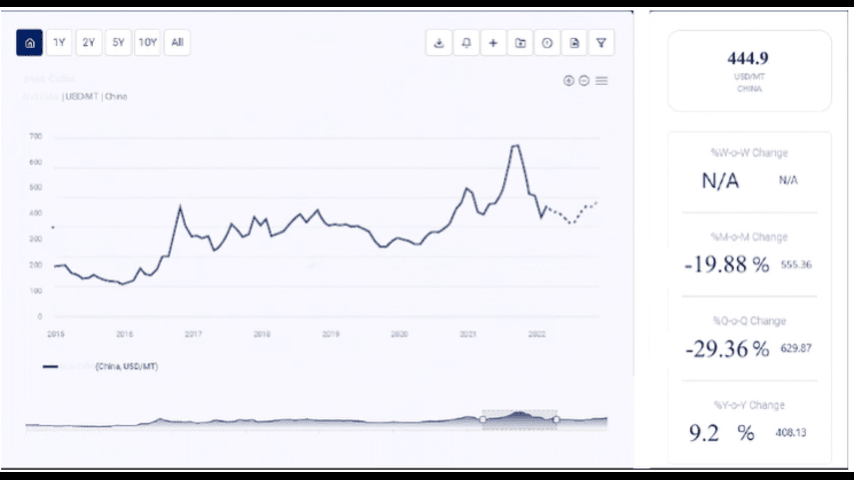

Over the past decade, neodymium prices have exhibited considerable volatility, influenced by supply-demand dynamics, geopolitical factors, and technological advancements. In the early 2010s, prices were relatively stable, but began to rise sharply around 2017 due to increasing demand from the electronics and renewable energy sectors. By 2020, neodymium prices had peaked, driven by robust demand for electric vehicles (EVs) and wind turbines.

Enquire For Regular Prices: https://www.procurementresource.com/resource-center/neodymium-price-trends/pricerequest

Recent Price Movements (2021-2023)

From 2021 to 2023, neodymium prices faced downward pressure. In 2023, prices declined significantly due to decreased demand from the renewable energy sector and other industries, coupled with increased supply, particularly from China. According to Procurement Resource, the price trend suffered from a consistent decline in demand, leading to a drop of approximately 44.77% year-to-date by December 2023. This decline was exacerbated by economic uncertainties and weaker growth in key downstream industries such as automotive and electronics.

Factors Influencing Neodymium Prices

1. Demand from Key Industries

Neodymium is crucial for producing high-strength magnets used in various applications, including EV motors, wind turbines, and consumer electronics. The demand from these industries significantly impacts neodymium prices. For instance, the growing adoption of EVs and renewable energy technologies has historically driven demand for neodymium magnets.

2. Supply Chain Dynamics

China is the dominant supplier of neodymium, accounting for a significant portion of global production. Any changes in Chinese production quotas, export policies, or geopolitical tensions can significantly affect global supply and prices. In recent years, China has increased its production quotas for rare earth elements, including neodymium, to meet rising domestic and international demand.

3. Technological Advancements

Advancements in magnet technology and efforts to develop alternatives to neodymium-based magnets can influence demand and prices. Continuous research and development aimed at increasing the efficiency and reducing the size of neodymium magnets drive demand, but any breakthrough in alternative technologies could potentially reduce dependence on neodymium.

4. Geopolitical Factors

Geopolitical events, such as trade tensions and export restrictions, can disrupt the supply chain and impact prices. For example, recent export controls by China on rare earth elements, in response to geopolitical tensions, have created uncertainties in the market.

5. Economic Conditions

Global economic conditions, including GDP growth rates, currency exchange rates, and inflation, also play a crucial role in determining neodymium prices. Economic downturns typically reduce industrial demand for neodymium, while strong economic growth can boost it.

Price Forecast for 2024

Expected Price Range

Analysts predict that neodymium prices will continue to experience volatility in 2024. The price is expected to incline due to a widening gap between supply and demand, driven by ongoing robust demand from the automotive and electronics sectors and limited supply. Forecasts suggest prices could range between $70 and $100 per kilogram.

Potential Scenarios

- Optimistic Scenario: Strong demand from the EV and renewable energy sectors, coupled with stable supply, could drive prices towards the higher end of the forecast range ($90 to $100 per kilogram).

- Pessimistic Scenario: If economic conditions weaken and demand from key industries decreases, prices could hover around the lower end of the forecast range ($70 to $80 per kilogram).

Key Industry Developments

Expansion and Production

Several key companies are expanding their production capacities to meet rising demand. For instance, Lynas Corporation is increasing its production capabilities with new facilities in Australia and Malaysia. Similarly, other companies like MP Materials and Rainbow Rare Earths are investing in new projects to enhance their supply chains and reduce reliance on Chinese production.

Sustainability Initiatives

Efforts to develop more sustainable mining and processing methods for neodymium are underway. These initiatives aim to reduce the environmental impact of neodymium production and ensure a more stable and sustainable supply.

Technological Innovations

Continuous advancements in magnet technology are expected to drive efficiency and reduce costs. Research into alternative materials and improved recycling processes could also influence neodymium demand and supply dynamics.

Conclusion

Neodymium prices are set to remain volatile in 2024, driven by strong demand from key industries, supply chain dynamics, and economic conditions. While prices are expected to incline due to a supply-demand gap, ongoing technological advancements and geopolitical factors will continue to shape market trends. Stakeholders in the neodymium market must stay informed about these factors to navigate the complexities and capitalize on emerging opportunities.

For more detailed and up-to-date information, refer to market analysis reports and industry news from reliable sources such as Procurement Resource, Fortune Business Insights, and Investing News.