Ethylene oxide (EO) is a crucial chemical used in the production of various products such as ethylene glycol, glycol ethers, and surfactants. The market for ethylene oxide has been influenced by several factors, including supply chain dynamics, raw material availability, and global economic conditions. This article provides an in-depth analysis of the historical of ethylene oxide price trend, the factors affecting these trends, and a forecast for 2024.

Historical Overview of Ethylene Oxide PricesRecent Price Movements (2021-2023)In recent years, the prices of ethylene oxide have exhibited considerable variability. Key trends observed from 2021 to 2023 include:

- 2021-2022: The market saw significant fluctuations due to disruptions in supply chains caused by the COVID-19 pandemic, increased demand from the healthcare sector, and varying availability of raw materials. Prices generally increased during this period due to high demand and supply constraints.

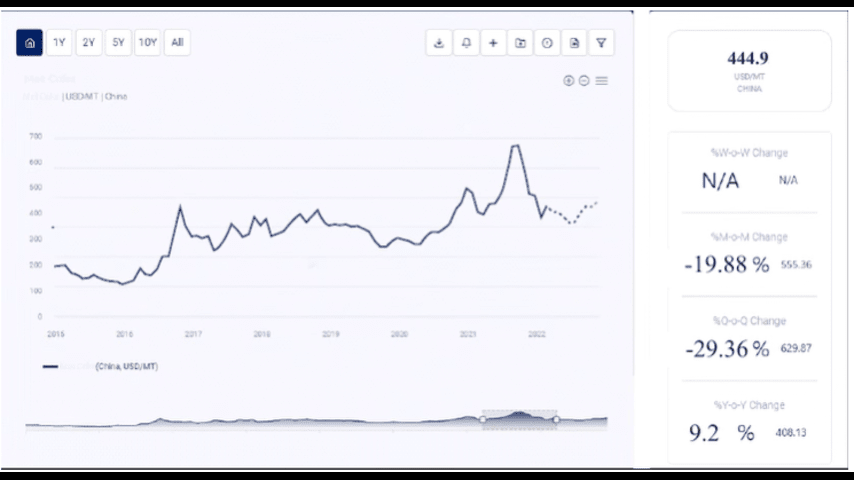

- 2023: The prices of ethylene oxide showed a mixed trend across different regions. In North America, prices fluctuated due to limited material availability and moderate demand from downstream industries such as ethoxylates and monoethylene glycol. The prices were affected by supply disruptions from major producers like Dow Chemical and LyondellBasell. In China, prices increased slightly in early 2024 due to strong demand and tight supply conditions.

Enquire For Regular Prices: www.procurementresource.com/resource-center/ethylene-oxide-price-trends/pricerequest

Factors Influencing Ethylene Oxide Prices

Supply Chain DynamicsThe supply chain for ethylene oxide is complex and can be affected by various factors such as plant shutdowns, maintenance activities, and geopolitical tensions. For instance, the shutdown of Dow Plaquemine and the closure of LyondellBasell’s ethylene oxide production in Bayport, Texas, significantly impacted supply in North America in 2023.

2. Raw Material CostsEthylene oxide production is highly dependent on the availability and price of ethylene, its primary feedstock. Fluctuations in ethylene prices, driven by crude oil price changes and availability, directly influence ethylene oxide prices.

3. Demand from Key IndustriesEthylene oxide is used in producing ethylene glycol (used in antifreeze and polyester production), surfactants, ethanolamines, and other chemicals. The demand from these industries, particularly in the automotive, textile, and healthcare sectors, plays a significant role in determining ethylene oxide prices.

4. Economic and Geopolitical FactorsGlobal economic conditions and geopolitical events can impact ethylene oxide prices. Economic slowdowns typically reduce industrial demand, while geopolitical tensions can disrupt supply chains and lead to price volatility.

Price Forecast for 2024Expected Price RangeAnalysts predict that ethylene oxide prices will exhibit some volatility in 2024, with an expected trading range between USD 1,300 and USD 1,600 per metric ton. This forecast considers stable demand from key industries and anticipated improvements in supply chain efficiencies.

Potential Scenarios

- Optimistic Scenario: If global economic conditions improve and demand from sectors such as automotive and textiles increases, prices could trend towards the higher end of the forecast range (USD 1,500 to USD 1,600 per metric ton).

- Pessimistic Scenario: Conversely, if economic growth slows and demand decreases, prices might settle at the lower end of the forecast range (USD 1,300 to USD 1,400 per metric ton).

Strategic Insights for StakeholdersFor ConsumersConsumers can manage costs by purchasing ethylene oxide in bulk during periods of lower prices and negotiating long-term contracts with suppliers to lock in favorable rates.

For ProducersProducers should focus on optimizing production processes and securing stable supply chains. Investing in sustainable practices and diversifying sources of raw materials can help mitigate the impact of price volatility.

For Traders and InvestorsTraders and investors should monitor market trends closely and use financial instruments such as futures contracts to hedge against price volatility. Staying informed about geopolitical developments and economic indicators will be crucial for making informed trading decisions.

Conclusion

The ethylene oxide market in 2024 is expected to be influenced by a complex interplay of supply chain dynamics, raw material costs, and demand from key industries. While prices are anticipated to remain relatively stable with potential for moderate increases, strategic planning and adaptability will be essential for stakeholders to navigate the market effectively. By understanding the underlying factors and staying informed about market trends, consumers, producers, and traders can make better decisions and capitalize on emerging opportunities in the ethylene oxide market.