Automated Teller Machines (ATMs) have become an integral part of the modern financial landscape, providing convenient access to cash and banking services. As their usage increases, so does the need for reliable and secure maintenance. This is where ATM maintenance companies come into play. These specialized firms offer a range of services that ensure ATMs remain operational, secure, and reliable. In this article, we will explore how ATM maintenance companies improve transaction security and reliability through their comprehensive maintenance services.

The Importance of ATM Maintenance

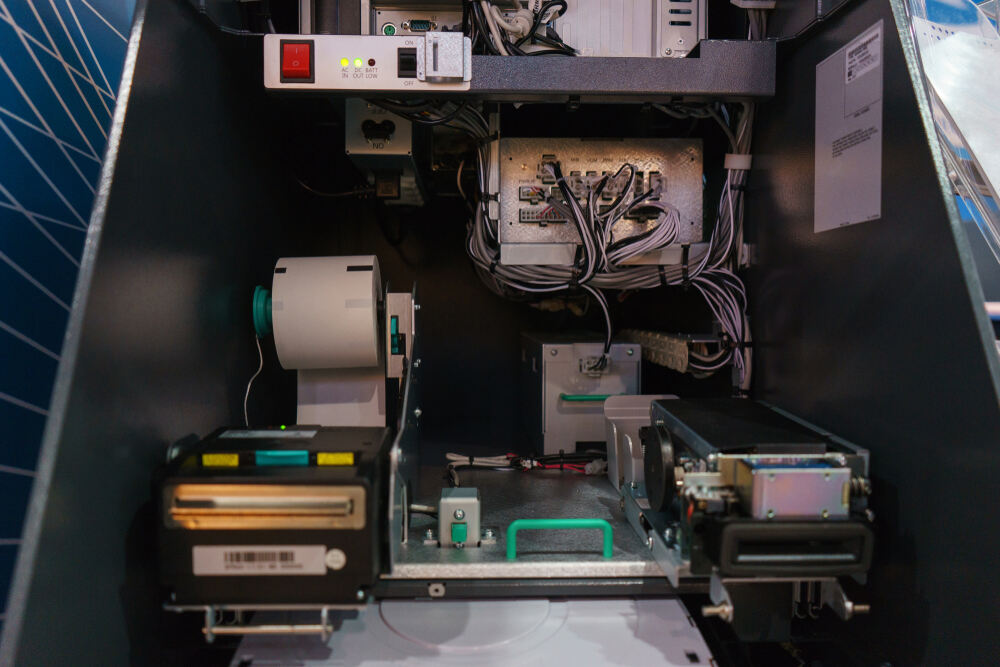

ATMs are complex machines that require regular upkeep to function optimally. Without proper maintenance, they can become susceptible to various issues such as hardware failures, software glitches, and security vulnerabilities. This can lead to downtime, which not only frustrates customers but also impacts the financial institutions’ reputation and profitability. Therefore, regular ATM machine maintenance is crucial to ensure that these machines operate smoothly and securely.

Comprehensive ATM Maintenance Services

ATM maintenance companies offer a wide range of services designed to keep ATMs in peak condition. These services include preventive maintenance, corrective maintenance, and emergency repairs.

Preventive Maintenance

Preventive maintenance involves routine inspections and servicing to identify and address potential issues before they become major problems. This includes checking and replacing worn-out parts, updating software, and ensuring that all components are functioning correctly. By performing regular preventive maintenance, ATM maintenance companies can significantly reduce the likelihood of unexpected breakdowns and security breaches.

Corrective Maintenance

Despite the best preventive measures, ATMs can still encounter issues that require immediate attention. Corrective maintenance involves repairing or replacing faulty components to restore the ATM’s functionality. This can include fixing card readers, cash dispensers, and other critical parts. ATM maintenance companies have skilled technicians who can quickly diagnose and resolve these issues, minimizing downtime and ensuring that customers can continue to access banking services.

Emergency Repairs

In the event of a sudden malfunction or security breach, ATM maintenance companies offer emergency repair services. These services are available 24/7 to address urgent issues and restore the ATM’s operation as quickly as possible. Having a reliable ATM maintenance provider ensures that any unexpected problems are dealt with promptly, reducing the risk of extended downtime and potential financial losses.

Enhancing Transaction Security

Security is a top priority for ATM maintenance companies. With the rise of sophisticated cyber-attacks and physical tampering attempts, ensuring the security of ATM transactions has become more challenging than ever. Here are some ways ATM maintenance companies enhance transaction security:

Regular Security Audits

ATM maintenance companies conduct regular security audits to identify vulnerabilities and implement necessary improvements. These audits include checking for any signs of tampering, ensuring that all security software is up-to-date, and reviewing access controls. By performing these audits, ATM maintenance companies can proactively address security risks and prevent unauthorized access to sensitive information.

Anti-Skimming Devices

Skimming is a common form of ATM fraud where criminals attach devices to ATMs to steal card information. ATM maintenance companies install and maintain anti-skimming devices to protect against such attacks. These devices detect and prevent skimming attempts, ensuring that customers’ card information remains secure.

Software Updates and Patches

Outdated software can leave ATMs vulnerable to cyber-attacks. ATM maintenance companies regularly update and patch the software to protect against the latest threats. This includes updating the operating system, security software, and any other applications running on the ATM. Keeping the software up-to-date is essential for maintaining the integrity and security of ATM transactions.

Improving Reliability

Reliability is another critical aspect of ATM maintenance. Customers expect ATMs to be available and fully functional whenever they need them. ATM maintenance companies play a vital role in ensuring the reliability of these machines through the following measures:

Regular Inspections and Testing

ATM maintenance companies conduct regular inspections and testing to ensure that all components are working correctly. This includes checking the cash dispenser, card reader, printer, and other critical parts. By identifying and addressing potential issues early, these companies can prevent malfunctions and ensure that ATMs remain operational.

Efficient Cash Management

One of the common issues with ATMs is running out of cash, which can be frustrating for customers. ATM maintenance companies use sophisticated cash management systems to monitor cash levels and ensure timely replenishment. This helps maintain a steady supply of cash and reduces the likelihood of ATMs running out of money.

Remote Monitoring and Diagnostics

Many ATM maintenance companies offer remote monitoring and diagnostics services. This allows them to track the status of ATMs in real-time and identify potential issues before they escalate. Remote monitoring also enables technicians to perform certain maintenance tasks remotely, reducing the need for on-site visits and minimizing downtime.

Conclusion

ATM maintenance companies play a crucial role in improving the security and reliability of ATM transactions. Through comprehensive maintenance services, regular security audits, and the implementation of advanced security measures, these companies ensure that ATMs remain operational and secure. By partnering with a reputable ATM maintenance provider, financial institutions can enhance customer satisfaction, protect sensitive information, and maintain the reliability of their ATM networks. Investing in professional ATM maintenance services is essential for safeguarding the integrity of financial transactions in today’s increasingly digital world.